Save more—calculate your benefits

Evaluate the cost advantage compared to other trade assurance solutions.

If you’d like further insights,

Details of our fee policy

Transaction amount (USD/EUR) Transaction amount (USD/EUR) | Applied rate Applied rate | Formula for fee calculation Formula for fee calculation |

|---|---|---|

0 < USD/EUR ≤ 50,000 | 0.7% | X × 0.70% |

50,000 < USD/EUR ≤ 100,000 | 0.4% | 350 + (X - 50,000) × 0.40% |

100,000 < USD/EUR ≤ 1,000,000 | 0.2% | 550 + (X - 100,000) × 0.20% |

1,000,000 < USD/EUR | 0.1% | 2,350 + (X - 1,000,000) × 0.10% |

Eliminate payment risks with Tridge Pay’s escrow solution.

Trade payments shouldn’t be difficult. Trust issues, upfront payments, and high banking fees create unnecessary risks. Our secure escrow solution, backed by Deutsche Bank, protects both buyers and suppliers—ensuring payments are safe and transactions run smoothly.

Unlike traditional payment methods that expose you to financial uncertainty and risk, our trade escrow solution ensures that funds are only released when shipment conditions are met. That means safer transactions, smoother negotiations, and stronger trust between buyers and suppliers.

The hidden risks in how you pay today.

Old payment methods slow you down and leave you exposed. We’ll help you trade with less risk, more trust, and fewer delays—here’s how.

Wire transfers in CAD — high risk, no security.

Buyers worry about fraud and delays. Suppliers worry they won’t get paid.

With Tridge Pay...

payments are held in escrow, removing the risk of advance payments so both sides can negotiate with confidence.

Letters of credit — expensive and inaccessible.

L/Cs protect payments but are expensive and hard to access for many businesses.

With Tridge Pay...

any company can secure transactions at low cost, without credit requirements or banking complexity.

General escrow — not built for trade.

Most escrow services are designed for small peer-to-peer transactions.

With Tridge Pay...

you get a solution built exclusively for trade, with low fees (Max 0.7%), secure Deutsche Bank escrow accounts, and a fair contract structure for both sides.

How Tridge Pay compares to traditional solutions.

Wire transfers, L/Cs, and generic escrows weren’t built for you. We give you a simpler, safer way to trade—without the cost, risk, or delays.

Tridge PayTridge Pay | Online escrowOnline escrow | Letter of credit at sightLetter of credit at sight | Wire transfer (CAD)(Cash Against Document) Wire transfer (CAD)(Cash Against Document) | |

|---|---|---|---|---|

Protection against fraud | ||||

Protection against delayed/canceled shipment | ||||

Affordable for B2B (Base fee as of the total transaction amount, adjusted upon client credit rating) | 0.1~0.7% | 1.0~3.0% | 1.0% | Fixed transfer fee |

No cumbersome paperwork | ||||

Low cost and no hidden fees (Bank transfer charges are separate) |

Tridge Pay

Tridge PayTridge Pay | |

|---|---|

Protection against fraud | |

Protection against delayed/canceled shipment | |

Affordable for B2B | 0.1~0.7% |

No cumbersome paperwork | |

Low cost and no hidden fees |

Built for real trade, not workarounds.

Most solutions weren’t made for real trade. We’ll give you the structure, protection, and flexibility you need to trade with confidence.

Shipment-based escrow contracts.

Payments are only released when the buyer confirms the original bill of lading (B/L), ensuring trust on both sides.

Optimized fee structure.

No hidden costs. Tridge Pay supports both container shipments and bulk transactions with fair, scalable pricing.

Funds secured at Deutsche Bank under Hong Kong regulation.

Funds are secured through Deutsche Bank Hong Kong’s virtual account system, enabling safe, compliant cross-border transactions.

With Tridge Pay, both sides win.

Most solutions weren’t made for real trade. We’ll give you the structure, protection, and flexibility you need to trade with confidence.

For buyers

Simple protection against fraud.

Trusted infrastructure, global compliance.

You're handling serious transactions—we make sure they're backed by the right systems. From licensing to security, we give you the confidence to trade anywhere in the world.

Escrow account under Deutsche Bank HK.

Your funds are held in escrow accounts operated by a trusted global bank.

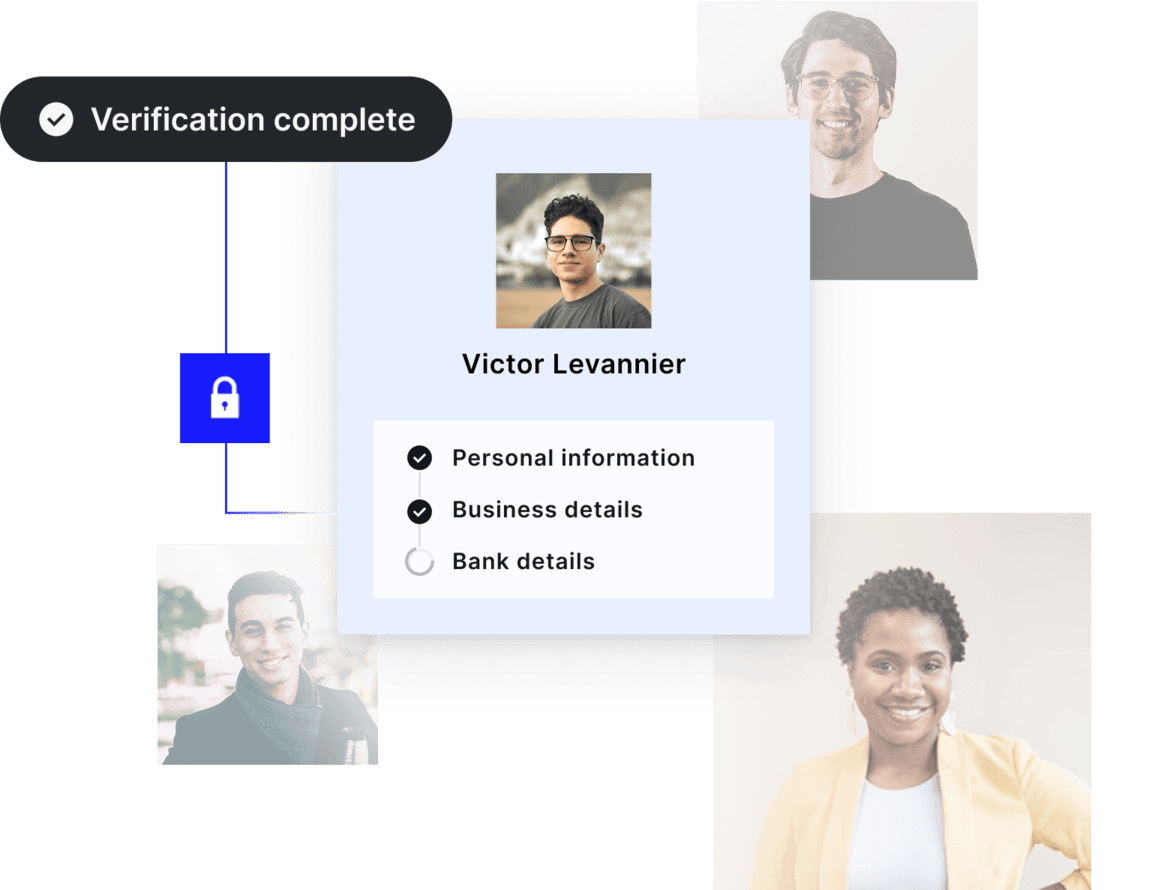

Licensed under TCSP in Hong Kong.

We operate as a regulated Trust or Company Service Provider – License #TC009320.

Security you can rely on.

Every transaction is protected with 2FA, encryption, and real-time monitoring to keep your data and funds safe.

Approved by Hong Kong Customs & Excise.

Authorized under AML/CFT regulation under Customs & Excise department of HKSAR.

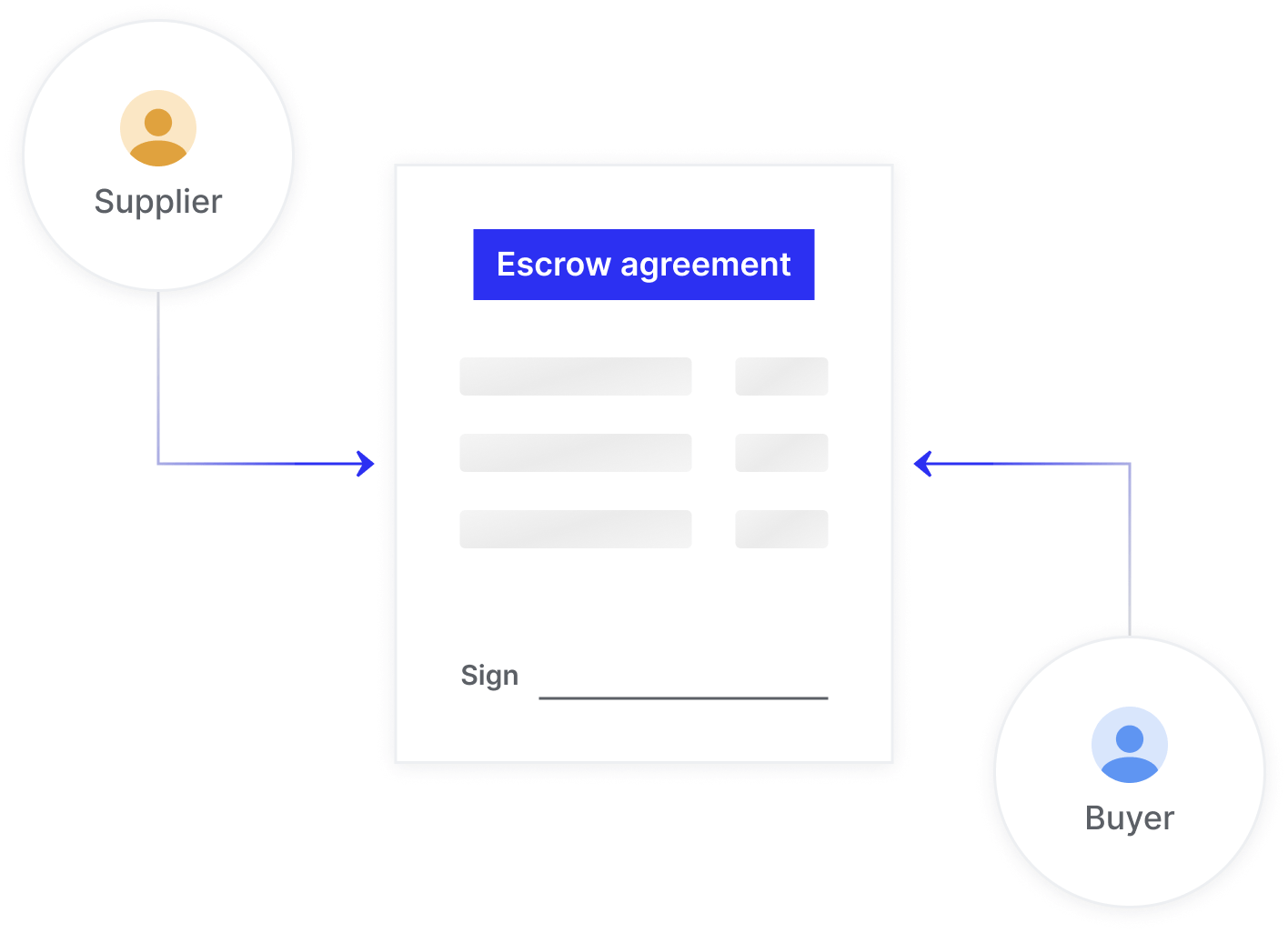

How our escrow process keeps your trade secure.

We make it easy to trade with confidence. Here’s how the escrow flow works—step by step.

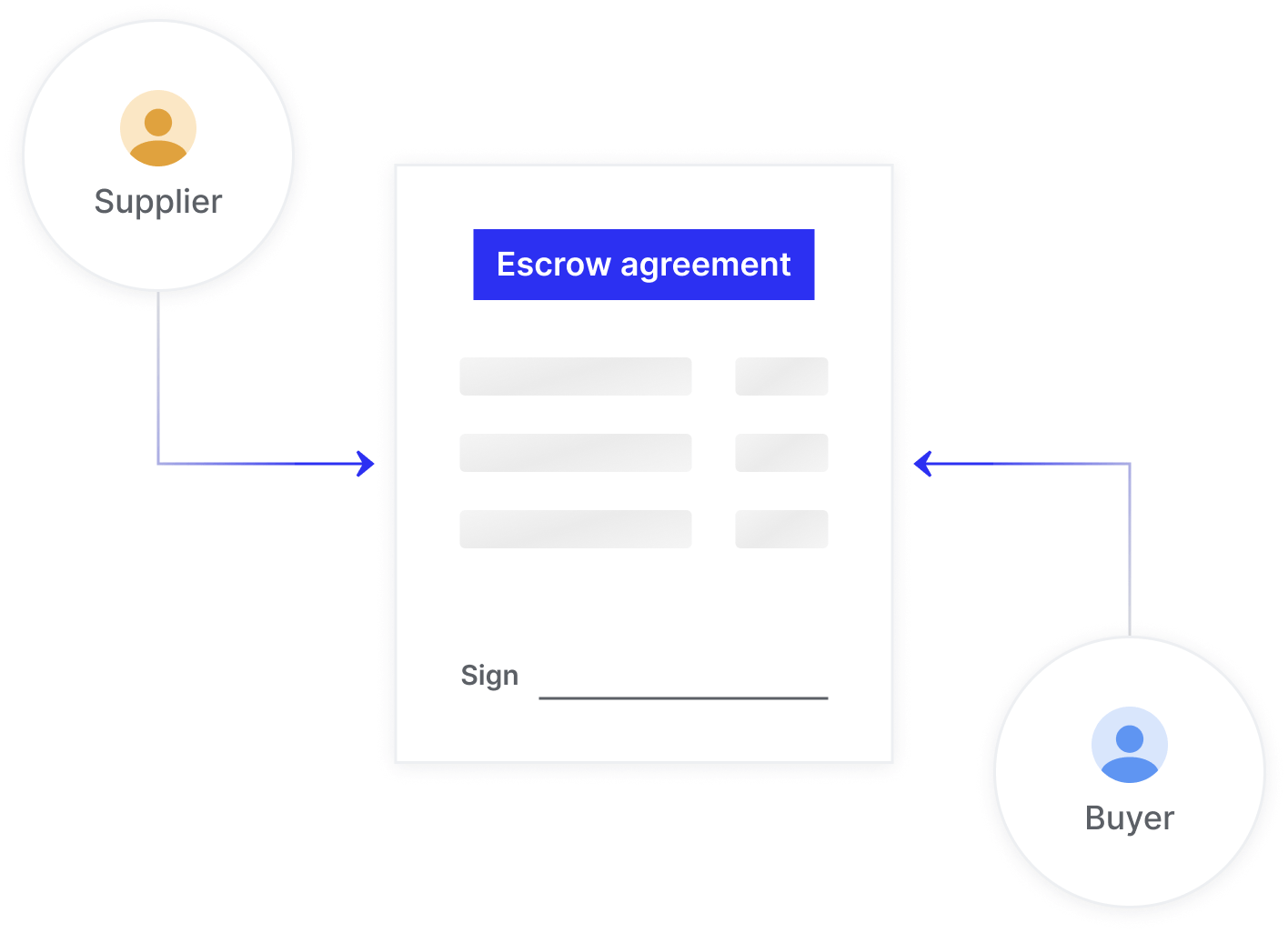

- 01

Agree on terms.

Authorized under AML/CFT regulation under Customs & Excise department of HKSAR. - 02

Buyer sends funds..

The buyer transfers payment into a Deutsche Bank-backed escrow account, where funds are securely held under the supervision of financial authorities. - 03

Shipment & verification.

The supplier ships the goods. The buyer verifies delivery and proof of shipment. - 04

Funds are released.

Once the buyer confirms shipment, funds are released to the supplier—on time and without dispute.

01

Agree on terms.

Authorized under AML/CFT regulation under Customs & Excise department of HKSAR.

Supports all types of shipments.

Whether you’re moving small quantities or large volumes, we’ve got you covered.

Bulk commodities.

Grains, edible oils, sugar, and more.

Containerized shipments.

Standard cargo across sea routes.

Air freight.

Ideal for samples or time-sensitive products.

How real companies use Tridge Pay.

Tridge Pay has been a game-changer for our high-value transactions. The secure payment solution has enabled us to close deals faster and more efficiently, without losing potential buyers due to payment security concerns. Tridge Pay is an essential tool for any serious trader!

MSM (South Africa)

Gerhard Potgieter, Head of Sales & Marketing

Dealing with Letters of Credit was always costly and complicated, but Tridge Pay has changed that for us. Their escrow protection is tailored for cross-border transactions, and the fee rates are very reasonable. It’s the solution we’ve been waiting for!

LOOHOPE INTERNATIONAL (Taiwan)

Lai Chao-yu, Director of Purchase

Handling delayed payments was always a challenge, even with our existing customers. Tridge Pay’s simple escrow system has safeguarded both us and our buyers, reducing the time and cost associated with managing payments.

Fish Box Sarl (Mauritania)

Fouad Hoballah, CEO